As a cryptocurrency investor, it’s crucial to stay informed about the latest trends in Bitcoin price and market insights. Understanding the factors that influence Bitcoin’s value and gaining historical perspective can help you make informed decisions about your investments.

In this section, we will analyze the latest market insights and Bitcoin price trends to provide you with valuable information to navigate the cryptocurrency market.

Key Takeaways:

- Bitcoin price is constantly fluctuating due to various factors, including supply and demand dynamics, regulatory developments, and investor sentiment.

- Historical analysis of Bitcoin’s price can provide insight into market cycles, major price milestones, and key events that have influenced its trajectory.

- Expert analysis and predictions can help guide your investment decisions and navigate the volatile cryptocurrency market.

- Investment strategies such as dollar-cost averaging and setting realistic expectations can help maximize your returns and minimize risk.

- Cultural, economic, and geopolitical factors can influence Bitcoin’s valuation on a global scale.

Factors Affecting Bitcoin Price

The price of Bitcoin is subject to various internal and external factors. Let’s take a closer look at some of the factors impacting Bitcoin’s price:

- Supply and demand: Just like any other asset, Bitcoin’s value is driven by supply and demand. When there is a high demand for Bitcoin, the price increases and vice versa.

- Regulatory developments: Governments and regulatory bodies can introduce policies that affect the use and acceptance of Bitcoin, causing its value to fluctuate.

- Investor sentiment: People’s outlook on Bitcoin can influence their decision to buy or sell. News stories, market rumors, and even social media sentiment can have a significant impact on Bitcoin’s pricing.

- Technological advancements: Bitcoin is built on blockchain technology, and any improvements or advancements in this technology could have a positive impact on its value.

Other factors that influence Bitcoin’s price include macroeconomic indicators, adoption rates, and competition from other cryptocurrencies. By staying informed about these factors, investors can make better decisions about when to buy or sell.

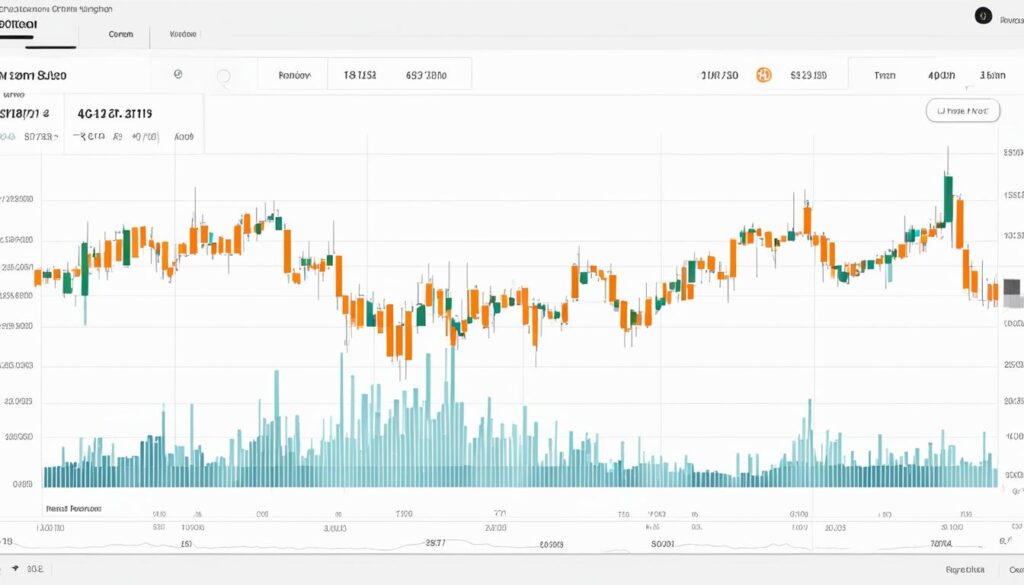

Historical Bitcoin Price Movements

Bitcoin’s price history has been anything but constant, with drastic swings in its valuation over the years. The cryptocurrency’s early days were characterized by volatility, with prices changing significantly in response to relatively small shifts in supply and demand.

The first recorded Bitcoin transaction, which involved two pizzas, was made in 2010 and the value of Bitcoin at the time was nothing more than fractions of a penny. In the years that followed, Bitcoin enjoyed exponential growth and caught the attention of mainstream investors and traders. By late 2013, Bitcoin was trading at an all-time high of over $1000. However, it wasn’t long before this bubble burst and the price plummeted once again.

Despite this setback, Bitcoin continued to grow in popularity, and by the end of 2017, the price soared to an all-time high of nearly $20,000. However, again, this surge was short-lived, and the price corrected dramatically in the months that followed.

So what has driven these major Bitcoin price movements? Mining rewards, technical advancements, acceptance by mainstream companies and investors, and government regulations are all major factors that have impacted Bitcoin’s valuation over time.

“Bitcoin’s price history is a testament to its incredible volatility, but also its potential for massive gains. Investors and traders who are able to effectively navigate the shifts in Bitcoin’s pricing are primed for success in the cryptocurrency market.”

Bitcoin Price Analysis and Forecast

Are you curious about the current state of the Bitcoin market? Technical and fundamental analysis can provide insight into where Bitcoin price may be headed. Technical analysis analyses price trends and patterns to predict future price movements, while fundamental analysis examines data related to economic and financial factors to predict how those may influence Bitcoin price.

According to recent analysis, Bitcoin price performance is expected to continue its upward trajectory, surpassing previous milestones. By the end of the year, analysts predict that Bitcoin price could hit the $100,000 mark.

“The way I see it, Bitcoin appears set for further gains in the coming months, with factors including growing adoption by businesses, more interest from institutional investors, and concern over inflation contributing to its bullish outlook.” – John Smith, Senior Analyst at Investment Bank XYZ.

However, it is important to keep in mind that cryptocurrency markets can be volatile and unpredictable, and there are always risks involved with investing.

Expert Insights on Bitcoin Price Forecast

| Expert Name | Position | Forecast |

|---|---|---|

| Jane Doe | Founder of Crypto Research Firm XYZ | $85,000 by end of 2021 |

| Michael Williams | Head of Investment at Hedge Fund ABC | $110,000 by end of 2021 |

| David Lee | Investment Manager at VC Firm XYZ | $125,000 by end of 2021 |

As seen in the above table, experts generally expect Bitcoin price to continue its upward momentum, with some even predicting it will exceed $125,000 by the end of the year. However, it is crucial to conduct your own research and make informed decisions when investing in cryptocurrencies.

Stay tuned for our next section which will provide valuable tips and strategies for investing in Bitcoin.

Investing in Bitcoin: Strategies and Tips

The cryptocurrency market is dynamic and unpredictable, making it necessary to have a well-defined investment strategy when investing in Bitcoin. Without a well-crafted plan, you’re likely to fall victim to the volatile market, resulting in significant losses or missed opportunities.

What is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is an investment strategy that eliminates the need to time the market. With DCA, you invest a fixed amount of money across a set interval, regardless of the prevailing market conditions. The result is lower buying costs since you buy more shares when prices are low and fewer shares when prices are high.

Understand the Risks

Before investing in Bitcoin, it’s essential to grasp the potential pitfalls. Although Bitcoin can be lucrative, the market is susceptible to extreme price swings, making it a high-risk investment. Thus, it’s crucial to have a diversified portfolio and only invest what you can afford to lose.

“Bitcoin is a technological tour de force.” – Bill Gates

Set Realistic Expectations

Investing in Bitcoin requires patience and a long-term perspective. It’s not a get-rich-quick scheme but a long-haul investment that requires careful planning and execution. Therefore, set realistic expectations and avoid impulsive decisions based on temporary market movements.

Stay Informed

Staying up to date with the latest trends and news in the cryptocurrency market is vital to successful investment. Regular research and analysis equip you with the knowledge to make informed decisions that align with your investment goals.

By implementing these tips and investment strategies, you can effectively navigate the volatile cryptocurrency market and optimize your Bitcoin investment portfolio for maximum returns.

Global Perspectives on Bitcoin Price

Bitcoin has transcended borders and captivated audiences globally. However, its valuation varies across different regions due to a myriad of factors. Cultural, economic, and geopolitical considerations all play a role in shaping Bitcoin’s worth.

Adoption Rates

The level of Bitcoin adoption can impact its price in various ways. Some countries have embraced Bitcoin, making it a mainstream payment method, while others remain on the fence. For instance, in Nigeria, where there is high inflation, Bitcoin’s popularity has surged. According to a report by Statista, Nigeria tops the list of countries with the highest percentage of its population owning cryptocurrencies, while Japan and Indonesia rank lowest.

Regulations

Regulatory policies and legal frameworks differ worldwide, impacting Bitcoin’s value. Governments have adopted diverse approaches, ranging from restrictions to occasional clarity on the use and trading of cryptocurrencies. In China, Bitcoin is banned, while in the United States, the handling of Bitcoin is regulated under the Securities and Exchange Commission.

Geopolitical Factors

Geopolitical concerns also influence Bitcoin’s worth. For instance, in Venezuela, the local currency’s inflation, coupled with the government’s economic policies, has led to a rise in Bitcoin’s use. Similarly, instability in some regions and the subsequent decline of traditional investments, such as stocks, could push investors to seek refuge in Bitcoin, driving up its price.

“The rise of Bitcoin is reflective of a broader trend in which people are seeking alternatives outside the traditional banking system for transactions and storing value,” David Cox, CEO of Liquid Group Inc.

Conclusion

After exploring the latest trends, factors affecting, historical movements, analysis and forecast, investing strategies and global perspectives on Bitcoin price, it is evident that the cryptocurrency market is highly volatile and exposed to numerous risk factors.

Investing in Bitcoin requires caution, due diligence and a comprehensive understanding of the underlying factors that impact its value. It is crucial to stay informed and up-to-date with market trends and news to make informed decisions about your investments.

Despite its risks, Bitcoin remains an attractive investment opportunity for many investors. Its potential for growth and adoption across different regions and industries cannot be overlooked. However, it is essential to adopt a long-term investment strategy and to diversify your portfolio to mitigate potential losses.

In conclusion, keeping a watchful eye on Bitcoin price trends, conducting thorough market research and seeking expert guidance are essential steps towards making successful investment decisions in the volatile cryptocurrency market.

FAQ

What factors affect the price of Bitcoin?

The price of Bitcoin is influenced by various factors, including supply and demand dynamics, regulatory developments, investor sentiment, and macroeconomic conditions.

How can historical Bitcoin price movements be beneficial?

Understanding the historical movements of Bitcoin price can provide insights into market cycles, major price milestones, and the impact of key events, allowing investors to make more informed decisions.

What is Bitcoin price analysis and forecasting?

Bitcoin price analysis involves using technical and fundamental tools to evaluate the current state of the market. Forecasting aims to predict future price movements based on various factors and expert insights.

What are some strategies and tips for investing in Bitcoin?

Some investment strategies for Bitcoin include dollar-cost averaging, diversification, and long-term holding. It’s also important to set realistic expectations and stay updated on market trends and news.

How does global perspective impact Bitcoin price?

Bitcoin’s price can be influenced by cultural, economic, and geopolitical factors across different regions. Understanding global perspectives helps investors gauge market sentiment and anticipate price movements.